The plan to increase charter capital was developed by the Board of Directors (BCG - HOSE) to pay the debts that have been used to purchase assets, investing in sustainable development in the face of global economic challenges, in order to survive and thrive.

The 2022 Annual General Meeting of Shareholders of Bamboo Capital Joint Stock Company (BCG) on May 6 is expected to have many important resolutions approved.

The first is about increasing capital. The company plans to issue more than 518 million shares. In which, Bamboo Capital offers 268.3 million shares to existing shareholders at the ratio 2:1, VND 10,000/share.

Along with that, the company will sell 250 million shares to the public by putting up for auction, the starting price is at least 70% of the average of 60 consecutive trading days on the market up to the decision day.

Together with 25.3 million dividend stocks and 5 million ESOP shares, the total value of shares is forecasted to be VND 5,183 billion. Therefore, after the issuance, the charter capital of Bamboo Capital is expected to reach VND 10,500 billion.

This issuance, according to the BOD, is to finance the debts that have been transformed to assets and support sustainable development in the face of global economic challenges. After the issuance, Bamboo Capital is going to deleverage with a debt/equity ratio of about 1.5 times. That helps to build long-term wealth without incurring much debt.

On December 31, 2021, BCG's total assets reached nearly VND 38,000 billion, an increase of 56.7% compared to the beginning of the year. In 2021, BCG balanced its financial structure by converting 900 billion dong of bonds into shares, issuing shares to existing shareholders at the ratio of 2:1. A strong increase in equity has helped the Group's debt-to-equity ratio decrease to 3.47 from 7.15 times by the end of last year.

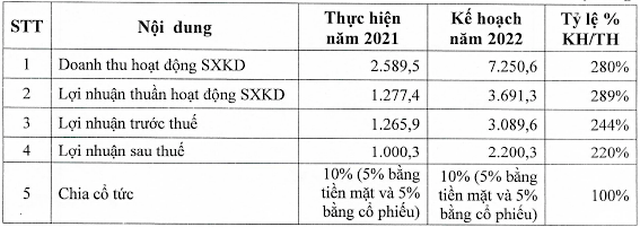

Secondly, the Board of Directors also built a plan to maintain high profits and earnings per share. In 2022, the Company sets a planned after-tax profit of VND 2,200 billion, equals to 220% the prior year.

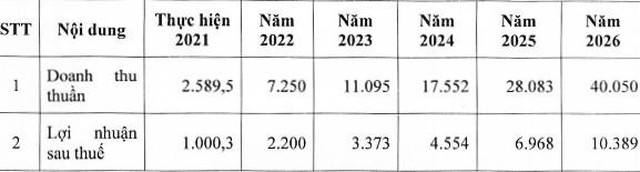

The business plan for the period from 2022 to 2026 was built by the Board of Directors based on steady increase in net revenue and net profit over recent years, with its ambition is to exceed VND 10,000 billion in after-tax profit by 2026 .

BCG continues to make a bulk of its revenues on real estate and clean energy. From the end of last year, BCG Energy Joint Stock Company, Bamboo Capital's subsidiary, has had about 600 MW capacity of solar energy.

This year, BCG Energy plans to install 500 MW wind power, aside from 300 MW of solar power and 150 MW of rooftop solar power. The charter capital of BCG Energy is expected to increase to VND 4,000 billion, as a part of a greater ambition to IPO, with the planned electricity generation capacity of about 2GW by 2025.

VNECO Vinh Long factory of BCG

Regarding of the real estate segment, the company sets business goals of nearly 5,000 billion dong in revenue and 1,200 billion dong in profit, mainly from Malibu Hoi An project and more than 200 shophouses of D'or Hoi An project.

In addition, this year, BCG Land is expected to implement three more projects, a 33-ha in Binh Dinh, a 20-ha in Dak Nong and a 20-ha in Quang Ngai.

Thirdly, the Board of Directors plans to submit to the shareholders' meeting a resolution on renaming to Bamboo Capital Corporation, marking the transition from a joint stock company model to a multi-industry corporation, to keep up with global business management.

After a decade, Bamboo Capital has become a conglomerate with 78 subsidiaries and affiliates, more than 2,000 employees. BCG also has completed the overall business picture with seven key areas including Renewable Energy, Construction - Infrastructure, Real Estate, Manufacturing - Trading, Finance - Insurance, Real estate services and manufacturing & trading of pharmaceuticals.

Bamboo Capital plans to develop into a business ecosystem, creating strong internal relationships to support each member, help each one make good use of its competitive advantage. This has been proven a winning business model in large corporations around the world.

With an ambitious strategy, Bamboo Capital said it would always adapt to changes, to build a flourish business in the next few years.

According to Stock Investment (Đầu Tư Chứng Khoán).