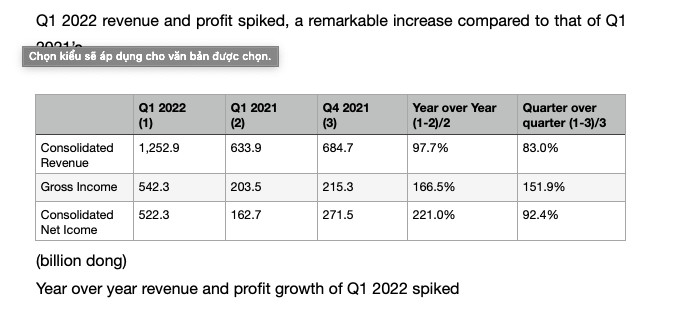

Bamboo Capital Joint Stock Company (HoSE: BCG) has just announced its financial reports for the first quarter of 2022. BCG revenue reached VND 1,263 billion, after-tax profit reached VND 522 billion, an increase of 98% and 221% respectively over the same period last year.

BCG's revenue breakdown by sector shows that the real estate segment (BCG Land) accounted for VND 477 billion, renewable energy segment (BCG Energy) made up VND 211 billion, construction - infrastructure segment (TCD) contributed VND 445 billion, finance - insurance business only contributed 47 billion dong. Thus, construction, real estate and renewable energy were BCG's three most profitable lines of business.

The construction segment still contributes a stable income to the parent company. Meanwhile, the renewable energy segment shows a considerable growth over the same period thanks to revenue from BCG Long An solar power plant 1 and BCG Long An solar power plant 2 (total capacity of 141.1MW). BCG has purchased the shares to wholly own the two plants. The real estate segment continues to generate revenue from the handover of the King Crown Village project.

Consolidated profit after tax reached a record high, 522.3 billion dong in the first quarter of 2022, increase to 221% over the same period. The real estate segment was a key contributor with VND 337.9 billion thanks to the project handover, along with the noticeable profit from selling the Pegas Nha Trang hotel. Therefore, BCG's gross profit margin improved significantly, increasing to 42.9% compared to 32.1% of the same period last year.

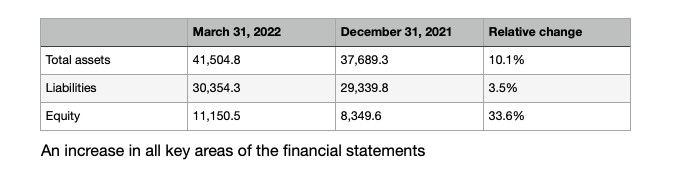

Earlier this year, BCG issued more than 148 million shares to existing shareholders with the ratio 2:1. With a successful issuance rate of approximately 100%, BCG raised its charter capital from VND 2,975 billion to VND 4,463 billion. Thereby, equity increased by 33.6% from 8,349.6 billion VND to 11,150.5 billion VND.

On March 31, 2022, BCG's total assets had increased by 10% compared to the beginning of the year, reaching VND 41,504 billion due to the growth of fixed assets. This demonstrated the company's efforts in investing, ensuring the progress and quality of projects.

At the end of the first quarter this year, BCG's liabilities were VND 30,354 billion, an increase of VND 1,015 billion compared to the beginning of the year. Although total liabilities are relatively high, the quarter-over-quarter growth in debt since the beginning of 2021 has been negligible.

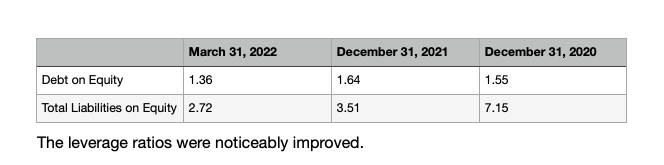

BCG has been very careful to minimize financial risks. BCG's debt-to-equity ratio has decreased from 7.15 times at the end of 2020 to 3.51 times at the end of 2021. By the end of the first quarter of 2022, BCG's debt-to-equity ratio continued to decrease to 2.72 times.

Besides, BCG's debt-to-equity ratio also decreased from 1.64 to 1.36 times. BCG's management is financially restructuring to maintain the ratio below 2 in 2022 to ensure stable development in the face of global challenges and ensure benefit for shareholders.

The current ratio is 1.75 times, which is higher than that of the same period last year (1.41), indicates that the company's solvency has improved significantly which has helped minimize financial risk.

In 2022, the board of directors plans to submit to the General Meeting of Shareholders on May 6 the resolution of reaching 7,250 billion VND in revenue and 2,200 billion VND in profit after tax - an increase of 280% and 220% respectively compared to last year's. If approved, by the end of the first quarter, BCG completed 17.4% of the planned revenue and 23.7% of the planned profit.

A few days ago, due to the volatile stock market, Bamboo Capital's stock experienced a sharp decrease from VND 28,650/share to VND 17,300/share. However, according to Mr. Nguyen Ho Nam - Chairman of BCG, the plunge was only short-term and temporarily affected the price, it will not and cannot affect the long-term prospects of the corporation. Mr. Nam also added that BCG is on track, in the second quarter of 2022, the corporation is expected to still improve business performance compared to the same period last year.

According to Vneconomy