On the eve of the 2022 annual general meeting of shareholders taking place on May 6, Investment Magazine (Báo ĐầuTư) had an interview with Mr. Nguyen The Tai - Vice Chairman and General Director of Bamboo Capital (BCG: HOSE) on growing areas of interest to many investors.

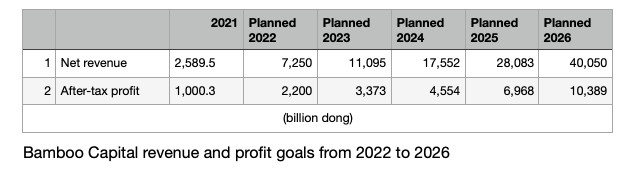

BCG sets a target of VND 7,250 billion in revenue and VND 2,200 billion in profit this year and more than 10,000 billion VND in profit in 2026. Isn't it too ambitious, sir?

Outsiders may probably think that BCG is growing too fast. However, as the business leader, I've witnessed what BCG has been experiencing for more than 10 years, I believe that the Group is on the path of sustainable development.

Looking back at the period from 2011 to 2018, BCG's annual revenue and profit was quite modest because we were preparing key resources, building a foundation for further rapid development following the corporate model which includes many industries. Thanks to that solid foundation, since 2019, BCG has growing considerably.

Even during 2020-2021, amid great unprecedented challenges due to COVID-19, BCG still grew rapidly thanks to its multi-industry ecosystem, in which each business can support any others effectively.

BCG possesses competitive advantage for sustainable development, including potential projects, optimal operating models, market insights, abundant key resources, and the ability to mobilize domestic as well as international capital. I believe these strengths will help BCG grow and flourish further, especially while the Government is promoting public investment including infrastructure, and renewable energy.

BCG's revenue and profit in recent years was very impressive, but bond and liabilities have also increased over the years, what do you think about this?

Recently, there has been a lot of negative information and opinions on bond issuance in the market, which have led to investment fear. Bond or debt is not bad, this is actually a financial leverage to help businesses grow. The problem lies with how the company uses it and how to maintain an optimal financial structure.

BCG's short-term and long-term bond is about 9,097 billion dong, which is at average level compared to other corporations of similar size.

BCG and its subsidiaries always comply with the laws, capital from the bonds have been used to finance projects which have a reliable payback period and debt repayment plan to ensure the benefits of bondholders.

In 2021, although it was not required by law, Bamboo Capital already requested for rating service and has been assessed by FiinRatings with a positive outlook.

The Group's total liabilities by the end of the first quarter of 2022 was VND 30,345 billion, above average. However, the debt growth rate since the beginning of 2021 has not been significant, BCG has put enormous efforts to improve its financial structure, the debt-to-equity ratio has continuously decreased from 7.15 at the end of 2020 to 3.51 by the end of 2021. By this March, this ratio continued to decrease to 2.72 times.

In 2022, we plan to reduce the debt-to-equity ratio to below 2 and then below 1 in the near future. This will be the ideal financial structure to help BCG develop sustainably and cope with fluctuations in markets.

According to the the resolution, this year BCG is expected to increase its charter capital to about VND 10,000 billion and contribute worth of VND 5,000 billion capital to BCG Financial. This is considered a major development, can you share more about this?

The charter capital and equity of BCG are about VND 5,000 billion and VND 11,000 million respectively. Those amounts should be good enough for on going projects.

However, in order to reach its full potential, capital mobilization is obviously essential.

A successful capital raise will help BCG generate higher revenue and profit, lead to greater shareholder value. This is our main goal.

BCG's upcoming plan is to contribute VND5,000 billion to BCG Financial to increase capital for AAA Insurance, meanwhile to prepare resources for AAA Insurance to grow rapidly in the non-life insurance sector and develop more insurance products to boost revenue.

Through BCG Financial, BCG also plans to invest in the FinTech segment of Bamboo ID Company to develop a digital banking platform; besides, we will also make long-term investments in banking and spend more on M&A in the financial sector.

We are going to make full use of our strengths, utilize the invaluable experience in the financial field and golden opportunities from the market to gain competitive advantage, build the foundation for a solid financial plan to effectively support the BCG ecosystem.

Switching to a multi-industry corporation model, how is BCG organized for innovation and restructuring to minimize risks and ensure sustainable growth?

This is an interesting question and also a concern of many investors as BCG has continuously grown and expanded into new market.

The fact is that BCG did not become a conglomerate overnight, but it had had an elaborate preparation. We believe that becoming a conglomerate which is a corporation made up of several different, independent businesses is the right strategy. We also spent a long time preparing resources, key personnel and risk management skill to avoid falling into the “expansion trap”.

There is a connection and mutual support between BCG's businesses, which have been developed based on BCG's strengths, such as renewable energy, construction - infrastructure , real estate, manufacturing - trading and finance - insurance.

BCG plans an organizational restructuring following hybrid group structure model.

For example, Tracodi is expected to become a general contractor, can handle large important infrastructure projects, under Tracodi will be subcontractors. Similarly, BCG Land, BCG Energy and Nguyen Hoang or BCG Financial are on the same track.

BCG and its subsidiaries all possess potentials and advantages for sustainable development.

What need to be done in each company, each business segment are very different, but it boils down to business strategies, key personnel, resolving difficulties (capital, raw materials, operating model, etc), opportunity seizing capability and risk management.

BCG's 5 million bonus shares (ESOP) are attracting attention of many shareholders. Can you share more about this plan?

They are basically payment to employees through shares, this is actually the salary cost from the after-tax profit. This encourages everyone to work for the long-term goals.

We could have chosen to pay either a high salary initially or bonus to employees, they would have been operating expenses.

But as BCG needs more resource for business growth, so we offered a lower salary but with incentive, which means employees will receive bonus shares if they hit their KPIs. The transferring is restricted for a certain time as usual also help strengthen the relationship between employees and BCG while increasing long-term shareholder value.

Business performance last year showed that BCG exceeded its planned after-tax profit by 24% in a turbulent year due to the pandemic. Although last year's general meeting of shareholders approved bonus of up to 10% of profit after tax, the Board of Directors decided to spend only 5% of profit after tax on performance bonus, or about VND 50 billion for employees.

In 2020, BCG also exceeded the planned after-tax profit by 44% and the ESOP was approved by the General Meeting of Shareholders. However, after all the company turned it down in order to maximize dividends.

BCG exceeded its initial 2021 plan by more than VND 200 billion so 5 million shares performance bonus to employees is reasonable, this ensures benefits of both employees and shareholders.

The bonus was based on the profit after tax, not on the exceeded expectation because managers and employees are the ones who generated that amount, and the growth of the corporation and share price also benefits investors.

The company's annual business plans are usually very challenging and affected by many different factors. They are real challenges, and obviously it is impossible to always exceed the ambitious goals.

Profit sharing which is an incentivized compensation program that awards employees based on the company's profits is quite popular around the world to motivate employees.

Bamboo Capital Joint Stock Company will hold the online 2022 Annual General Meeting of Shareholders on May 6. Important resolutions are expected to be submitted, including 2022 business plan, increasing capital to more than 10,094 billion by the end of 2022, contributing 5,000 billion VND to BCG Financial; paying 5% cash and 5% stocks dividends in 2021, issuing 5 million bonus shares (ESOP) to employees, changing the company name to Bamboo Capital Group Joint Stock Company.

According to Phong Lan

Đầu Tư Chứng Khoán newspaper